Moving Back to Canada

Resources for Expatriate Canadians returning to Canada after living in the U.S. or further abroad

Moving to Canada with a wine collection?

Here's how to import it

Many Canadians living in California, France, Germany, or other wine-rich areas of the world build lovely wine collections. When the time comes to move back to Canada, their wine collection is part of their household and naturally, it should come too. Easy, right?

Unfortunately, not. Here are some key things you need to understand:

- Each province is responsible for its alcohol laws and alcohol import processes. All provinces tightly control the importation, distribution, and retailing of wine, beer, and hard liquors - even imports from other provinces! Obviously this is for public health concerns, but it is even more important to their revenues...tax revenues. There is so much tax revenue generated from wine, beer, cider, and hard liquor sales every year that each province relies heavily on it to meet their budgetary needs.

- BC and Ontario produce lots of their own wine. So the governments of these provinces are even more sensitive to imports from other provinces and countries than the non-wine producing Canadian provinces. Wine production is big business, employs a lot of people, and generates tons of tourism revenue. Tourism generates more tax revenue for all levels of government from this side of the industry, too. Except of course in 2020 and 2021 when revenues from Tourism in BC plummeted to a tiny fraction of their norms.

- The federal government in Canada brings in substantial duties and taxes from alcohol importation and sales, too. Billions of dollars every year.

Why all this information? So that you will understand why you must go through the following steps in order to bring your wine collection into Canada when you move. The government wants substantial duties and taxes from you if you choose to bring a collection to Canada.

What is a "wine collection"?

It is useful to define what a "wine collection" is as used in this resource. You can bring in collections of beer, whiskey, etc. but most people want to bring wine collections in. Yes, of course there are a some people who would bring in different kinds of alcohol and the process, in BC, for example, would be the same.

But, just for simplicity, let's stick to a "wine collection" being defined as 6 x 750ml bottles of wine, or more. Much more, in most people's collections: Dozens of bottles, and in some cases: hundreds of bottles.

How do you bring it or ship your collection to Canada?

There are several ways to bring or ship your wine to Canada:

- From the U.S. you can bring it yourself in a u-Haul or in your vehicle if you are bringing only a few cases of 12 bottles - up to 45 litres total (60 bottles x 750ml each).

- You can bring some cases on the plane with you as luggage. The Wine Check even offers special wine luggage you can use!

- You can air cargo a shipment. Some airlines will handle this with proper paperwork and pre-clearing with the Liquor Distribution Board of the province you are shipping to. You may need a Canadian Customs Broker to help with air cargo.

- A formal shipping company can handle wine collection shipping. Again, pre-clearance will be needed and the services of a Customs Broker will be very helpful. One client in January 2020 noted that her 80-100 bottles from CA was quoted as USD$4500 for shipping, much too high for her. As of the time of writing this she was considering other options.

- UPS and Fedex do not seem to be viable options for individuals. They do not allow liquor shipping and importing into Canada by individuals. However, a work-around can be to have a liquor retailer or wholesaler do the shipment for you through UPS or FedEX. This can work.

How many bottles can you import?

Note: I am going to use BC here as this is the province where I get overwhelmingly the most interest for bringing in wine collections. Each province will be a bit different in terms of their process so contact the Liquor Distribution Board in the province you are moving to in order to learn about their exact process. But you can use BC's situation as a general template for how wine importing works for all provinces.

To "import" a wine collection the Province of BC breaks down the volume into 3 categories. Other provinces have their own structures, but assume at this point that they are very similar. The first two categories are what are called "casual importation:"

- Up to 1.5 litres of wine (2 x 750ml bottles) may be brought into BC without duties or taxes, as long as you are bringing it physically with you when you come into Canada.

- Greater than 1.5 litres, up to 45.45 litres. In communicating with the BC Liquor Distribution board, I learned that up to 45.45 litres of wine (60 x 750ml bottles) maximum may be brought into BC under casual importation either accompanying you or shipped. See below for links to the full instructions from BCLDB on how to do this kind of importation of your wine collection.

- Larger collections (greater than 60 x 750ml bottles). Typically these arrive in a separate shipment. "As a former resident of Canada, you are not limited to the amount of liquor imported except very large quantities approved by our Director." The importation process is the same as with up to 45.45 litres. The BC Liquor Distribution Board "Settler's Effects Letter" explaining this. (PDF file that downloads when you click on the link)

The second category, 3 x 750ml bottles up to 60 bottles, is where many collections fit. You can bring it with you, as noted above, or you can have it shipped separately. This is a very doable volume for which you can handle the paperwork by yourself. "You may appoint a Customs Broker to submit all paperwork to the LDB on your behalf, however this is only an option and you may choose to represent yourself."

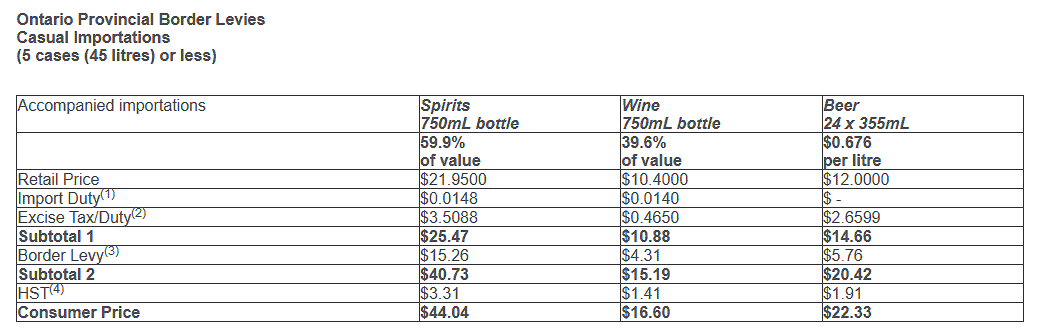

How much will it cost to import my collection?

There are many cost calculators out there for your specific case so the costs won't be covered in this resource. And of course, your provincial liquor board will be calculating all this for you, so you can see what it costs at the time of their assessment.

Here is a screenshot taken from the LCBO (Ontario) web site showing the calculations they use:

British Columbia's process for bringing in your wine collection

Again, please note that all other provinces have their own similar processes, but here is how it works in BC: (contact information for AGLC - Alberta, and LCBO - Ontario, noted later on this page)

Latest update to BC's process: May 2022. Before your wine collection is brought to, or shipped to, BC, the "Special Clearance Department" of the BC Liquor Distribution Branch (BCLDB) will be who you are working with. You need to contact them to handle the paperwork (contact details noted below).

Steps to follow for Canadian citizens and Permanent Residents only who are moving back to live in BC:

- "Casual importation - accompanying" - a collection of 45.45 litres or less that physically accompanies you as you come into Canada. Instructions from the BCLDB for accompanied collections.

- "Casual importation - not accompanying" (shipped) - a collection of 45.45 litres or less that is not accompanying you when you arrive. Instructions from the BCLDB for shipments.

- A larger collection than 45.45 litres? You will need to document your collection, so tax can be calculated on it. There are four ways of doing this:

- Use the BCLDB BCLDB Settler Alcohol List Template spreadsheet (downloads when you click on it) to account for the alcohol in your collection. This is for either bringing the collection physically with you or shipping it.

- Or: If your collection is a mix of bottles that you acquired over time, by computer (not by hand) produce a "Proforma Invoice" with the following information on it:

- Number of bottles

- Size of bottles

- Type of product (wine!)

- Percentage of alcohol

- The year of the product

- The name of the Winery that produced the wine, not the winery or shipper that shipped the product out.

- Transaction value (also previously known as Fair Market Value): Transaction value of the goods is the price actually paid or payable for the goods."

- Or, if you are shipping, say, 72 bottles of wine from one winery or retailer, they may have given you a commercial invoice. You can also use this invoice.

- Or you may use a Canada Customs Invoice (CCI).

- If you are shipping the wine collection you must produce a "Manifest (also known as an Advice Notice)". On the Manifest is the following information:

- "Consignee name should be the following:

BC Liquor Distribution Branch

C/O-XXX (your name)

1234 ABC Street, Vancouver, BC (your delivery address) - Shipper Name and Address

- Carrier Code and Cargo Control Number

- Date of Direct Shipment

- Port of Exit (if shipment is from the United States)

- Weight of shipment"

- "Consignee name should be the following:

- Send your BCLDB spreadsheet / Proforma Invoice / Commercial Invoice / Canada Customs Invoice and your Manifest (if shipping your collection) to the Special Clearances department of the BCLDB (contact information below)

- The BCLDB Special Clearances department will send you by fax or email their "Provincial Liquor Fee invoice" for your collection.

- If you are bringing the collection with you, you may pay the invoice at the border. In this case you have all the paperwork you need.

If you are shipping the collection, pay the invoice "in person or via mail (BCLDB only accepts exact amount in cash, money order, certified cheques or business cheques)." - For those shipping their collection, BCLDB will then send you a signed "B3" form, which is needed to clear the shipment at the border by your shipping company. By "clear the shipment", we mean "allow the shipment to go through Canada Customs at the border and then physically arrive at your home".

- "The broker or recipient [you, if you are doing this paperwork yourself] is also accountable for the Federal Charges that are on the B3 when it is submitted to CBSA for clearance." So, you pay any of these charges.

- Send the signed B3 form, with your proof of payment of the Federal Charges, to your shipping company for presentation to CBSA as the shipment arrives in Canada.

...and hopefully your wine collection arrives at your home!

Contact information

Here is the contact information for British Columbia:

Email: ldbcustoms@bcldb.com

Amanda Cheung

Special Clearance Supervisor, Wholesale Operations – Imports

Tel: 604-252-8771

Connie Harvey

Special Clearance Clerk, Wholesale Operations – Imports

Tel: 604-252-8783

Lynn Montgomery

Special Clearance Clerk, Wholesale Operations – Imports

Tel: 604-252-8798

BCLDB - Special Clearances Department

Feedback:

From a visitor to my web site: "...crazy markup [in BC] for wine 85% when brought with you across the border and 116% when shipped direct to you in Canada. Both do not include Federal Taxes or Duties!"

And a note on paying your required duties/taxes in BC from a client:

Just as an FYI - on the wine import, the only hiccup I had was how to pay the Provincial Taxes. They don't take credit cards so paying over the phone wasn't possible and they really wanted a cashiers check or similar to be brought to their office in Vancouver. Ultimately, the person you put me in contact with was able to setup payment at the border for when we crossed but the Federal office was confused about it when I arrived. Eventually they figured it out and it all worked.

Here is the full details page, including contact information, for Alberta - Alberta Gaming Liquor and Cannabis (AGLC):

Moving to Alberta

Here is the full details page, including contact information, for Ontario - the Liquor Control Board of Ontario (LCBO):

Importing Beverage Alcohol Products into Ontario for Personal Use

What about a really large collection - hundreds of bottles?

Very large collections follow the same process as smaller ones, but may have to be approved by the Director (in BC).

Alternatively, if you wish help with the moving of a very large collection a professional Mobility Consultant or specialty goods shipping company can either provide the help or move the collection for you.

Contributions & Feedback please!

This resource is updated regularly but be sure to contact the liquor control board (or whatever they are called in the province you are moving to) if you have a large collection so that you prepare fully and correctly for the move and avoid problems later.

Please share your learning and experiences, and suggest improvements, so that other Canadians moving back to Canada, and those moving here for the first time, may benefit from your experiences and wisdom.

Thank you!

Paul Kurucz

Latest update to this resource: May 2022.

Would you like help with your move?

Would you like help with your move?

Would you like help with your move?

I offer professional support to help you prepare for a smooth and easy return to Canada so you can feel confident and organized!

Your questions about when to move back, taxes, investments and finances, bringing back your household belongings, health care, and more will be answered promptly and professionally, with resources to back up what you need. My 20 years of supporting over 1,300 clients gives me a depth of expertise across all aspects of planning and returning to Canada.

Paul Kurucz - Canada

A happy client:

Hi Paul,

Just to update you - we landed and sailed through customs! So thank you so much for all of your advice...It was a thoroughly pleasant experience.

This is to say thank you for everything. Your advisory has been so incredibly helpful and saved us considerable time and removed room for error.

With best wishes,

Caroline

Paul's professional support

Moving Back to Canada Planner!

A ready-made and up-to-date planner of questions, considerations, and actions to take as you prepare for your move back to Canada, organized on a timeline approach. Save hours of work and stress of trying to piece everything together. A companion tool to the full content on this web site.

A ready-made and up-to-date planner of questions, considerations, and actions to take as you prepare for your move back to Canada, organized on a timeline approach. Save hours of work and stress of trying to piece everything together. A companion tool to the full content on this web site.

Now available for immediate download. In easily editable Microsoft Word format so you can customize it to meet your planning needs. Also in PDF format.

NEW! If you are in the U.S. and moving back to Canada quickly your purchase includes a new edition as well: "Moving back to Canada from the U.S. in 30 days or less", in Word and PDF formats.

Testimonials: "Your moving guides and checklists are unbelievably helpful - frankly I don't know what I would do without them. You have covered everything including many, many things I would not have thought of. Thank you!!!" - C.W. April 2022. "The list of tasks is very helpful as I’m a list person. Just love checking off the boxes!" and "I must say I truly appreciate having purchased your guide to moving back to Canada. While we are still a couple months away it has really helped me keep all the "balls in the air".

Bonus #1 ! Includes the guide: "Canada in 2024: 10 Insights to Empower Your New Life in Canada." Written by Paul Kurucz from his experience helping over 1,500 clients return to Canada, this guide will help you better understand the Canada you are coming back to!

Bonus #2 ! Includes the "Real Estate Selling and Moving Checklist" to help you prepare for your move back to Canada if you will be selling your house, townhouse, or condominium!

Purchase and Download now:

(PayPal, Visa, Mastercard, Amex)

Home | FAQ's | Contact | Get help - Professional Support

Commercial use: © 2003-2025 by Paul Kurucz.

Content from the Moving Back To Canada web site by Paul Kurucz is licensed under a Creative Commons Attribution 3.0 Unported License for non-commercial, personal use.