Moving Back to Canada

Resources for Expatriate Canadians returning to Canada after living in the U.S. or further abroad

Important News:

- There are no restrictions to coming to Canada at this time. As long as you have the legal right to enter Canada (because you are a citizen, Permanent Resident, or have an appropriate entry visa for your nationality) you can simply arrive and enter Canada.

- Should you move back to Canada from the UK in 2025?

Does it make sense to be leaving the UK and moving back to Canada at this time? Is it the right action if you want some peace from the chaos in the world? Will Canada in the coming year provide a respite and opportunities to set up a life you want?

Well, in some ways you can create a good life for yourself in Canada. But in others ways, questionable. The UK is open and free and so is Canada as of the latest update to this resource in Q3 2025. But Canada is suffering from some deep systemic problems like a very distressed health care system in BC and ON particularly, "complicated" (steadily declining!) real estate prices, rising unemployment, and an economy that is not getting better anytime soon. And we are next door to a quite unstable neighbour whose challenges could impact us directly and indirectly in the future.

So, what to do?

Suggestion: Consider your options carefully in light of your particular life context. Use the resources on this UK-specific page and this whole web site to help you plan a temporary, staged, or permanent return to Canada if it is the right thing for you to do in the coming months.

I have also created a special resource on considerations for moving back in 2025 that may help your decision making. - Move timing note:

You may move back to Canada and bring a UK citizen spouse with you as a long-term visitor, applying after you arrive under the "spousal sponsorship" category for them to have Permanent Resident status in Canada.

Need help with your move back to Canada? Please engage my professional support if I may be of be of help.

Welcome to the resource page for Canadians moving back from the UK! Here you will find resources and tips from other Canadians specific to your return to Canada.

The main Moving Back to Canada resource page has links to a full set of resources for you to access, so be sure to check it out as well!

Topics & Resources

- Introduction: commonalities and differences between the UK and Canada

- Should you move back?

- Retiring in Canada

- Moving your furniture & belongings

- Moving pets to Canada

- Tax considerations

- Foreign exchange: Moving GBP to CAD

- Your tips, suggestions, and feedback?

- Professional help for your move back

Introduction

Returning to Canada from the UK would seem to be a pretty straightforward move. After all, Canada is a former British colony, we share a common national language, and both countries are progressive and have modern societies.

Whether you considering moving to Canada from England, Ireland, or Scotland, there are many similarities. But there are also many differences between the UK and Canada to be aware of. This resource is designed to help you understand how Canada and the UK are different in order to empower you to decide two things:

- If the move back to Canada makes sense for you at this time in your life. And...

- ...if the answer is "yes", how to make your move back to Canada a smooth and confident one!

Most of the discussions I have with Canadian expatriates living in the UK include explorations of indecision around whether it makes sense to move back given their particular situation. Unlike their counterparts living in the U.S., who generally want to know the "hows" of moving back, Canadians living in the UK are more focused on the "should I move back?" question. Before we get into my insights gained from the many Canadians in the UK I have worked with here is a great little video on this topic in October 2023 by a Canadian who has lived in the UK for years: Is life better in Canada or UK (An Honest Review).

Let's start by looking at the commonalities and differences from the context of consideration of a move back to Canada:

Some of the commonalities between Canada and the UK:

- A tax treaty between both countries that ensures no double taxation for Canadian citizens living in either country and receiving income or pensions in the other.

- UK Pensions can be received in Canada...and vice versa.

- Many similar systems such as telephone, internet, financial linkages, and language, make the move easy in many ways.

- Canada is a former colony of the UK and as a result has many structural similarities, such as our parliamentary system, cultural traditions shared by large numbers of people in both countries, and close treaty and political alliances. The Queen of England still formally owns all the land in Canada (really!) and officially is our head of state, ruling Canada through a Governor General, Lieutenant Governors, and of course our "prime minister" and other ministers who "administer" Canada on her behalf.

- Similar health care philosophies. Canada has a very different system than the U.S. due to very different philosophies on health care. Our system is more like the UK's. See this site's health care in Canada page for more depth on this subject.

- A sense of mobility - people have been moving to and from Canada from the UK for literally hundreds of years.

- A strong focus on process - Americans have "the right to life, liberty, and the pursuit of money...oops sorry, HAPPINESS" as their founding principles. Canada and the UK are focused more on the right to good government, as it states in the Canadian constitution, for example. In recent times the term "good government" in Canada has never been more questionable, however. Beware that governing troubles in other countries are not unique to those places. Canada is also enduring questionable and sometime alarming leadership and governance.

- Expensive real estate. Perhaps this is not an admirable commonality, but Toronto and Vancouver particularly, are now "world class" cities in terms of real estate prices, right up there with London. Canada has the most expensive real estate compared to average incomes of any Western country.

Some of the differences between Canada and the UK, in the context of a potential move back:

- Differences in mind frame - The UK is oriented towards its own internal culture, the cultures of Europe, and cultures further abroad. It has little to do with Canadian culture. Canada is a nice ex-colony that it rules but Canada is not really where "life happens". For example, there are few television shows in the UK that put Canada at the centre of daily attention. Fun fact: The reverse is not true: Many people in Canada watch "Coronation Street"!

Canada's main focus is towards the U.S. in mind frame and culture. We do 70% +/- of our economic trade with America and get most of our entertainment from America, too. Especially in these trying political times, the focus of our attention is largely on what is happening in the U.S., though attention is increasingly turning inward as Canada begins to become aware of its own alarming internal problems.

This is a key difference: To many from the UK, Canada can seem like an extension of the U.S. in terms of ways of thinking. - Different cultures. The UK maintains an aspirational culture for most people who come to live there. They want to fit in, learn how to speak with a British accent, find their place in the UK cultural milieu, and thrill at the "culturedness" of life there.

Canada does not have this same attraction. Canada is a place you go to be safe from persecution, experience nature, have lots of social freedom, create a life for yourself, and raise your family in a prosperous manner. Some people who come to Canada retain more of their original culture rather than embrace "Canadian" culture. Why? Because there is no centralCanadian culture that is a common to most regions! This country is a mix of dozens of sub-cultures. And because of the vast size of Canada, these dozens of sub-cultures can usually co-exist pretty happily.

The key, then, is to find your specific sub-culture - the one you want to be with - in Canada. The same, of course, is true of the UK. Life in London can be culturally extremely different from life in Edinburgh, of course. You need to find where you "belong".

One reason many Canadians living in the UK have a challenge deciding if they should return is because they don't know how and where to fit into Canada after finding their "place" in the UK - a fit that is really comfortable for them. Moving back to Canada requires a significant cultural adjustment. Canada seems so similar but is really quite different from the UK and is very different even between and within regions in Canada. - Different geography. While the west coast of Canada can be as temperate and rainy as the UK in the winter, central Canada can be really, really cold. A person who moved to Ontario from the UK:

"I must confess I forgot how cold it gets here in winter."

Canada is a country with varying landscapes, weather, and geography types. And it is a vast country.

A real quote:

Q: "How are you going to get to Vancouver for your meeting tomorrow? [from Toronto]

The sheer size of Canada gives people a different sense of scope, perhaps, than that of people living in the UK. Cities are not as close together in Canada as they are in the UK. Canada is not close to various European centres in absolute terms, too. While you can easily fly from London on a super-cheap flight to a weekend in Paris, you cannot easily do the same between Vancouver and Paris or between Vancouver and New York.

A: "I'm going to take the overnight train."

Instead, Canada is a vast, remote, and separated place. Life in Vancouver is quite different from life in Toronto and is 3 time zones and many thousands of kilometres away by plane. Compare this to the distance between London and Edinburgh, which is less than 400km. One trip between cities in Canada is an expensive flight that takes most of a day of traveling. In the UK, a trip between cities can be a short direct flight or relaxed train ride away.

Note: Canadians do travel to the U.S. for weekend trips, but for different reasons: Seattle and San Francisco for west-coast culture, border cities for cheap food and gas, and Las Vegas for gambling and shows. These places, while of interest to North Americans, are not the same cultural experience as heading to Paris for the weekend.

Implication: I would argue that the UK is more "human scale" than Canada - it is a place where all manner of trips, experiences, and connections with people feel possible because distances are not that great between places there.

How might this factor affect those moving back to Canada from the UK? It might mean that Canada can impart a sense of isolation and separation that could lead to a feeling of disconnection and loneliness upon return. And I would suggest that this is not a factor to take lightly if you value close connections to family and friends and easy access to a variety of cultures. - Different systems such as electricity (220v), taxes, driving (left side of the road), etc. Education systems are a central difference, too. The UK school system is much older, more "structured", and wider reaching than in Canada. What I mean by this is that the aspirational culture of the UK, mentioned above, is fully supported by, and integrated with, the educational system. In Canada this can be confusing to many newcomers as they expect a more consistent and culturally focused experience than what Canadian schools actually offer.

A Canadian public school teacher, teaching in the UK, shares these perspectives:

- Different cost structures such as in travel, insurance, and rentals. If you are moving back to Canada to retire and have a quite limited income picture, be careful to choose a place in Canada where you can live the kind of lifestyle you wish, without feeling limited by your means for what you enjoy most.

M. Williams shares his experience moving back to Ontario:

I worked as a teacher in the Alberta school system before working as a teacher in the UK system for 10 years. I would pick Alberta’s school system in a heartbeat. There is a huge class divide here in the UK in terms of education. A private education does offer a more sophisticated option but state schools certainly do not. The curriculum was stable and well planned in Alberta. In the UK, it continuously changes according to whichever education minister is in power which causes immense problems for both staff and students. Recruitment is such an issue that many students outside of London end up taught by supply teachers for subject such as maths and sciences. However, the biggest drawback to me is that the UK system builds a sense of failure in most students from a very young age. Everything is about a test. The Canadian approach is more wholistic building confidence, breadth of subject knowledge (more like the IB program) and other important skills like teamwork and creativity. Canadian students consistently outrank UK students on international Pisa testing. If there is one thing that is drawing me back to Canada, from an educator's perspective, it is the wish for a Canadian education over a UK based one.

My first shock occurred 3 days after I arrived in June -- a dental emergency ended up costing me $1000 of which my travel insurance paid half. (Lesson - make sure you have travel/medical insurance and check that it covers dental). If my teeth had been injured I would have received full payment but root canal is not fully covered.

My second shock occurred this week -- the cost of car insurance!! Wow!!! In the UK, I paid roughly $350/year fully comprehensive. I've been getting quotes here in Ontario from between $1200-1700 per year! (4-5X higher!)

I've semi-retired and am living on a modest pension so this is not an insignificant cost. And, I need a car in order to get around. (Third shock is the shocking lack of affordable and convenient public transport that I was used to in Scotland -- and over 60s were given bus passes which allow you to travel free anywhere in Scotland + 1/3 off rail fares.)

If anyone has advice about cheap car insurance, I'd appreciate it.

Debbie B. shares her thoughts in 2021 on differences to get used to when you move back to Canada:

For Canadians returning from the UK after a long absence, they should steel themselves for a banking system that is much less user-friendly than the UK one. Simple transactions like setting up a regular loan payment are more complicated than in the UK. And they should be prepared for the shock discovery that you can't use debit cards for online transactions in Canada. Trying to get a credit card takes weeks rather than days. And if you're unlucky enough to be an HSBC customer, your debit card will not be contactless. I have no idea why, but there it is.

And get used to having to buy your alcohol at a different shop than your supermarket.

The other thing that mystified us at first was the lack of 'satnav' in cars. When we finally bought our car, we learned that everyone uses their phone and 'carplay' to navigate. Which works perfectly well, and cleared up the 'where's the satnav button' question for us.

But, and I can't stress this enough, it is wonderful to be back. We feel we decidedly 'dodged a bullet' by managing to get out of the UK when we did. We love the North Shore, with it's easy access to the waterfront and mountains. Ivor is golfing regularly and - once we get moved into the flat - I will be joining the local kayaking/rowing club in Deep Cove and getting back on the water in May. I miss being able to paddle, and can't wait to get going again.

Topics & Resources List | Your experiences? | Returning to Canada Support

How does this help you understand whether to move back to Canada?

Perhaps the following three questions can help with clarity on moving back, and whether it makes sense for you:

- Are you deeply embedded in the UK culture and society? If yes, removing yourself from that culture and trying to establish yourself in Canada may be a shock...and perhaps a big shock, one that could take years to come to grips with. One client I worked with was so torn between very close cultural and social ties in the UK and his desire to move back to Canada that he decided to stay in the UK.

- Canada is a vast place. It is not a "hop, skip, and a jump" away from Paris, per my example above. While many places in the UK are more costly to live in than Canada, wages and salaries in Canada are much lower, on average. This makes it harder to live an easy-flowing international lifestyle in Canada. If you live an urban, sophisticated, European-connected life in the UK then are you willing to give up the geographic accessibility and lifestyle you have now in order to live in Canada?

- How are you oriented? Toward creating your own life and culture or toward fitting into another? If you are a free thinker and love creating your own life amid generally open physical, mental, and social structures, Canada is for you. If you want to quickly plug into a culture that fits who you are and that gives you a sense of social/cultural security, the UK is perhaps a better choice (assuming the UK culture is the one you want to be part of!)

I worked recently with an actor and director client who really struggled with the decision to repatriate or not. She so dearly loved the culture of the UK and her exciting social life in London, hanging out with others who love art, film, and the deep cultural roots there. However, her real opportunities for professional growth were from offers of work in her native Vancouver and Los Angeles. What to do? This was a no-win situation for her. In the end, she did move back to Vancouver and has taken the next steps in her career there.

Joanne L. shares her considerations about moving back in 2021:

My husband and I moved here as young 20 somethings looking for adventure. He did a Doctorate at Cambridge and I started my professional career. Neither of us have ever really worked in Canada. We were part of the brain drain.

Twenty years on, we've built ourselves and our children a really nice life in central London. Many holidays to Europe, a beautiful home, fulfilling jobs, kids in great private schools and a nice set of friends. However, we are toying with moving back to spend more time with our ageing parents. I feel that we will be sacrificing a lot for our parents and wonder if this huge upheaval, risk and uncertainty - particularly now with a pandemic raging - will be worth it. I'm particularly worried about whether we will find jobs in Toronto in our mid-40s (again, with a recession-induced pandemic as a backdrop) as all of our professional contacts are in London. I'm also worried about whether our children will be forgoing a great education here.

I'd greatly appreciate any tips from anyone in a similar position, and whether your move back to Canada was fruitful in the end. Thank you.

Feedback shared with me by a UK writer and radio personality considering moving back to Canada:

My biggest concern is whether or not I can fit in after living away for 30 years. All my friends and professional contacts are in the UK. Also, I still have a son and grandson here too. But my brothers and sister, nieces, nephews, cousins live in Ontario (family) although I have few friends there anymore and very few professional contacts. But the desire to return to be near family was strong...Most of all I want to get re-acquainted with family but can I adapt to the culture after so long away??

A final note: UK expats, those moving to Canada permanently, and Canadian returnees from the UK have in recent years created stronger social ties to each other in Canada. UK style pubs, for example, are in every major city in Canada and it is quite easy to connect to others via social media and in-person. So, despite my challenging questions above, there are ways to move back to Canada and stay connected to British culture and interests.

Topics & Resources List | Your experiences? | Returning to Canada Support

Resources for returning to Canada from the UK

Retiring in Canada

A common question I hear from clients moving back from the UK:

"Can I move my pension to Canada?

When I clarify with them their goal in asking this question, I hear: They would like to move their entire state pension lump sum value to Canada to be paid to them in regular monthly payments by the Canadian government, not the UK government.

The answer: No.

Great idea, and it would simplify your monthly payments nicely, but you cannot move your whole pension as a lump sum to Canada.

Of course, when you move back to Canada you can receive your monthly pension payments, in GBP, to your bank account in Canada. You will have to deal with the conversion costs every month (fees and changing value of the GBP/CAD currencies) and there are some wrinkles, such as your pension won't "increase" every year because you don't live in the UK. The official UK Gov site on this. It can be a bit hard to decipher the actual impacts of moving to Canada from this site, but trust that you won't be double-taxed on your pension income.

Some feedback on *state* pensions from J. McBride, a Canadian in the UK:

Great website, thank you. But please point out that Canadians who have worked in the UK do NOT have 'favourable' pension arrangements if they retire in Canada. Their UK pensions are 'frozen' at the time they leave the UK for Canada, and are not uprated in line with inflation. (This is not true if they retire to some other countries, including the US).

This is a very sticky point for many retirees who have pensions coming from the UK that are not indexed because they live in Canada. There is a organization called Alliance of British Pensioners who are working to change this. I first learned about this group from a bumper sticker on a car in Victoria, BC!

For sure this is a concern, particularly in these times of change in the UK, Europe, and in Canada, too. If you are going to receive a fixed, non-indexed pension in Canada, the conversion rate between the GBP and CDN is of increased importance. If you see a slow degrade in the purchasing power of your pension over time, coupled with a decline in what the GBP/CDN exchange rate, you may find the quality of your lifestyle under threat. However, if the GBP strengthens when the country comes fully out of the BREXIT complications, you could see more CDN for your GBP when your pension gets send to you.

See the Foreign Exchange section on this page about historic conversion rates and if you are going to receive a fixed pension from the UK, please take care now to "hedge" other investments and savings to ensure that you can protect the quality of your lifestyle.

There is now a dedicated "Retiring in Canada" resource page on this site. Here you will find a pension terminology comparison chart and resources and tips covering the whole process of preparing and making the move back to Canada to retire. I created it in response to the growing number of returning Canadians who are returning to Canada from the UK, U.S., Australia, and further abroad to retire here.

Topics & Resources List | Your experiences? | Returning to Canada Support

Moving your belongings

Unless you plan to bring a few suitcases and boxes with you by air, a 20' or 40' sea container works well. The sea route between the UK and North America is direct and well-serviced by shipping companies, making a move to eastern and central Canada (Toronto, Ottawa, etc.) a pretty standard and relatively modestly priced move for the distance your belongings will travel. If you plan to move to the west coast of Canada plan for your container to take significantly longer to arrive as it will either go through the Panama canal or arrive on the east coast of Canada and be sent by train to the west coast.

What to bring:

Due to shipping costs, low-value items and those that won't be of use in Canada (appliances that run on 220v, for example) are not worth shipping.

Some general items that are worth shipping to Canada with you:

- higher value furnishings and rugs

- clothes

- books, entertainment collections

- laptop computers

- kitchen dishware, cutlery, etc.

What not to bring:

- vehicles - sorry, but only U.S. and originally Canadian vehicles can be imported. Exceptions: If your vehicle is over 15 years old there is a possibility that Transport Canada will allow you to import it. A classic collector vehicle, for example. This is a complicated process and can result in some significant expenses.

- appliances (different voltage).

- very low value items that can be purchased inexpensively in Canada.

Topics & Resources List | Your experiences? | Returning to Canada Support

Moving pets to Canada

Moving a beloved canine or feline family member from the UK to Canada is very doable! While larger animals (such as horses) or smaller ones (such as birds, ferrets, and even hamsters) can be moved, the process is different for each and physically bringing them presents some logistics challenges. If you have small or large animal, do research ahead of time what is possible and engage the help of an international pet moving service if you need really special care.

But for modest sized dogs and all house cats, Richard L. shares his experience and suggestions for preparing and flying with them to Canada:

After living in the UK for 20 years, I decided to move back to Canada after the passing of my second wife, to be closer to my children and grandchildren in the Toronto area. It was imperative that my little miniature dachshund come back with me. After research, I found that some airlines (including Air Canada) allow small dogs in the cabin with you. I made sure that the carrier was in compliance with the airline policy (size and weight) and that all his jabs were up to date including a Rabies vaccination (which is not usually given in the UK as Rabies does not exist there). Get a Pet Passport from your vet (that is essential).

Be aware, UK regulations state you can EXIT the UK with a dog/cat in cabin with you but you cannot ENTER the UK with a dog/cat in cabin. It is very important that when booking your flight, you state you wish to bring your dog on board with you and not in the "hold". There is a weight restriction on the size of the animal also so larger dogs cannot fly in cabin.

Confirm with the airline a few days before departure, that they have your pet marked for in cabin flight. Arriving at the airport only to find out they don't could be catastrophic. On the day of the flight, do not feed him and only give water. Your carrier can be lined with a puppy training pad in the even he needs to go desperately. Book in EARLY to deal with any issues that may arise. I had no trouble fortunately and all went well, We flew business class back to Canada and my dog Reggie was very well behaved.

We were of course on arrival at YYZ referred to secondary inspection, where I declared there was chattels and wares following. Border security and customs inspected Reggie's Pet Passport and flagged us through withy no issues whatsoever. Reggie became a Canadian Citizen immediately. Good luck / Bonne Chance.

Thank you, Richard, for laying out for others how to make the journey home with their pets smooth and easy!

Topics & Resources List | Your experiences? | Returning to Canada Support

Taxes

As mentioned above, Canada and the UK have a tax treaty and so you don't have to anticipate major tax problems when you move back to Canada.

Your return to Canada will likely entail advising investment, pension, and tax authorities in the UK with attendant paperwork to fill out. But again, there should be no significant tax impact to you as a result of your return and of being in Canada unless you have very significant investments you are keeping in the UK.

From the many UK clients I have worked with, one context does require some significant forethought and preparation: If you plan to continue owning real estate in the UK while living in Canada. In this case, be sure to get a credible third-party valuation done on your property around the time of your move to ensure that any capital gains that accrue after you move are accurately accounted for so that you won't pay tax on gains earned before you move. Note: Once you are resident in Canada your world-wide income and capital gains from all sources become taxable in Canada.

If your situation is complicated I do recommend engaging my services and perhaps also obtaining professional advice from a tax accountant in Canada who specializes in international taxes (I can help you assess whether you need an accountant).

Actually finding a professional tax accountant in Canada who has the expertise to handle the implications of a move from the UK is not easy! I have vetted lots of accountants across Canada and have only a handful who are both experts AND have great interpersonal skills. One individual and firm who stands out for UK / Canada tax planning and filing expertise:

Mo Ahmad

Founder and Partner

WestMark Tax

Canadian offices in Vancouver, Toronto, Calgary

Web site: WestMark Tax

Phone: 604.637.9775 (Vancouver)

Note: I receive no commission or kickback of any kind for this recommendation,

so you can trust that this is unbiased referral.

Topics & Resources List | Your experiences? | Returning to Canada Support

Transferring Funds to Canada & Foreign Exchange

Part 1: When to transfer funds to Canada

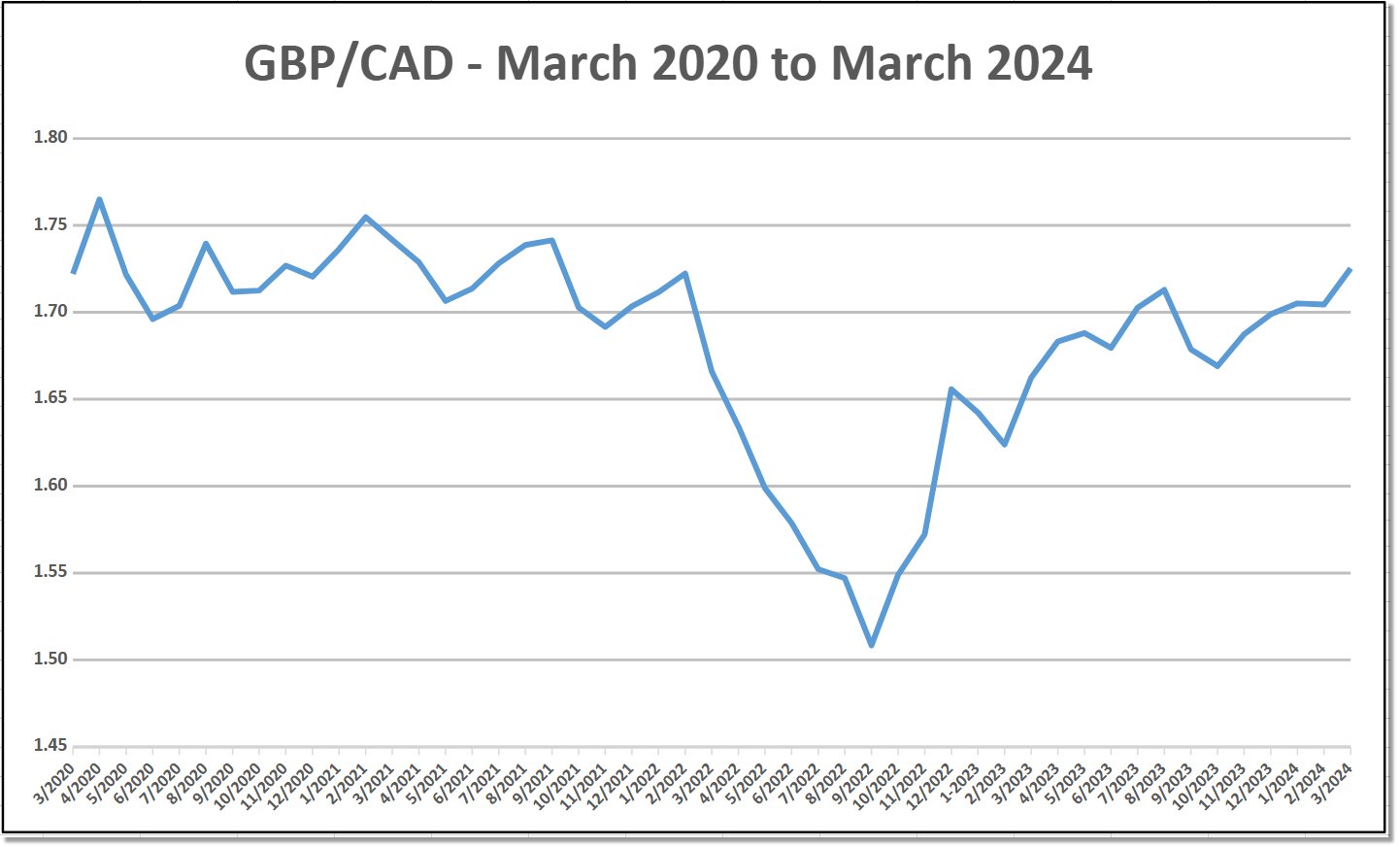

The UK economy is very different than Canada's and our respective currencies will not move in a predictable pattern between each other. Here is a 4 year graph of the GBP-CAD exchange rates, to give you a picture of where rates have been and are now:

Source of the data for this graph: OFX - Foreign Exchange.

As of the latest update of this chart, the GBP is well above the average exchange rate vis a vis the CAD for the last 4 years. This is a great time to do exchanges from GBP to CAD. Of course this may change at any time so keep an eye on exchange rates going forward. If you are moving back now and need to move a large amount as part of the move be sure to use a foreign exchange firm as they can help you get a "target" rate by timing a transfer to the market in a way that can save you thousands of dollars.

Some foreign exchange considerations:

- Will you be affected by fluctuations in the GBP/CAD exchange rate in the medium or long term? Many people have pensions that they cannot move to Canada and many also own property and/or investments in the UK that they intend to keep for 3-10+ years. This obviously makes foreign exchange rates of concern. As the graph above indicates, the ongoing economic uncertainties in the UK can have a major impact on your CAD income over time. Taking some time to think through the implications of foreign exchange rates in your situation is in your interest. As with tax issues, you might consider getting help if you have a complicated picture. Moving back to Canada should come with feeling financially safe and secure for the future.

- How long are you willing to keep a large amount of money in GBP, such as what you from the sale of a home, before you wish to convert some or all of it to CAD for your new life in Canada? The short term is uncertain. And if you can wait for years because you don't need the money until quite a ways down the road, the decision gets more complicated because the future relationship between the GBP and the CAD is quite uncertain as well. Trying to "time the market" for better exchange rates is a challenge even for investment experts. One strategy that professionals use that may be of value is to convert smaller lump sums of money at regular intervals rather than one big one. This is called "cost averaging". It generally is a lower risk approach than trying to "time the market".

Check today's current GBP to CAD exchange rate:

Note: Exchange rates change every minute and the rates quoted here are "Market" rates. Your final exchange rate will vary from it (more or less to you) depending on the rate at the time of your transaction.

Part 2: Exchanging funds to CAD from GBP (or another currency)

Suggestion: Don't transfer money to Canada through your bank and have your UK or Canadian bank do the foreign exchange for you as part of the transfer! If you are exchanging GBP to CAD and sending the funds to Canada use a dedicated foreign exchange company for the exchange. For GBP 5,000 or larger amounts, you can save hundreds or thousands of dollars on very large amounts compared to having your UK or Canadian bank do the transfer and exchange. Really. No joke. No risk. It just works.

Two foreign exchange firms that my clients recommend:

1. OFX is long-standing international and very professional foreign exchange firm. Many Canadians in the UK and around the world are very pleased with OFX for their one-time or on-going transfers + foreign exchange conversions (such as having pensions converted monthly on their way to Canada). OFX has offices in the UK and in Canada as well as other major financial centres. They offer excellent exchange rates that can save you at hundreds or thousands of dollars on larger amounts being converted.

OFX clients also love that they have a real person to talk to for questions about setting up an account or getting help with exchanges. And a big bonus: OFX can advise clients when a "target" exchange rate is reached so they can do the exchange then. What bank would do this for their customers?!?

2. Wise (former name: TransferWise) - Also used by many of my clients and by myself as well. Wise is high integrity, experienced, safe, transparent, straight-forward, and clear in their dealings with clients. Check out their nifty "borderless account" and Visa Debit card that allows you to hold many currencies and pay and withdraw from ATM's all over the world at the very best rates and without exchange fees. Note: Full disclosure that the link above is a referral link that will save you fees on your first transfer.

*** Learn more about transfers and foreign exchange companies in this dedicated resource: Transfers and Foreign Exchange

Your ideas, considerations, and experiences?

Please share your ideas, thoughts, and experiences relating to returning to Canada from the UK. Your input will really help others who are considering the move as well. A big thank you on behalf of the many people you will be helping!

Thank you!

Paul Kurucz

Canada

Latest update to this resource: August 2025.

Would you like help with your move?

Would you like help with your move?

Would you like help with your move?

I offer professional support to help you prepare for a smooth and easy return to Canada so you can feel confident and organized!

Your questions about when to move back, taxes, investments and finances, bringing back your household belongings, health care, and more will be answered promptly and professionally, with resources to back up what you need. My 20 years of supporting over 1,500 clients gives me a depth of expertise across all aspects of planning and returning to Canada.

Paul Kurucz - Canada

A happy client:

Hi Paul,

Just to update you - we landed and sailed through customs! So thank you so much for all of your advice...It was a thoroughly pleasant experience.

This is to say thank you for everything. Your advisory has been so incredibly helpful and saved us considerable time and removed room for error.

With best wishes,

Caroline

Feedback from a UK visitor to this web site:

Thank you for your informative site. I should have signed up for your support. I am ready to throw our belongings in the Atlantic I am so fed up with trying to figure everything out.

Paul's professional support

Moving Back to Canada Planner!

A ready-made, customizable list of things you have to prepare for your move back to Canada, organized on a timeline approach. Save hours of work and the stress that you might not think of it all.

A ready-made, customizable list of things you have to prepare for your move back to Canada, organized on a timeline approach. Save hours of work and the stress that you might not think of it all.

Now available for immediate download. In easily editable Microsoft Word format* so you can customize it to meet your planning needs.

Testimonials: "The list of tasks is very helpful as I’m a list person. Just love checking off the boxes!" and "I must say I truly appreciate having purchased your guide to moving back to Canada. While we are still a couple months away it has really helped me keep all the "balls in the air".

Bonus #1 ! Includes the guide: "Canada in 2023: 10 Insights to Empower Your New Life in Canada." Written by Paul Kurucz from his experience helping over 1,000 clients return to Canada, this guide will help you better understand the Canada you are movin back to!

Bonus #2 ! Includes the "Real Estate Selling and Moving Checklist" to help you prepare for your move back to Canada if you will be selling your house, townhouse, or condominium!

Purchase and Download now:

(PayPal, Visa, Mastercard, Amex)

* (If you don't have Microsoft Word, download the free OpenOffice software, which can open Microsoft Word documents easily)

Home | FAQ's | Contact | Get help - Professional Support

Commercial use: © 2003-2025 by Paul Kurucz.

Content from the Moving Back To Canada web site by Paul Kurucz is licensed under a Creative Commons Attribution 3.0 Unported License for non-commercial, personal use.